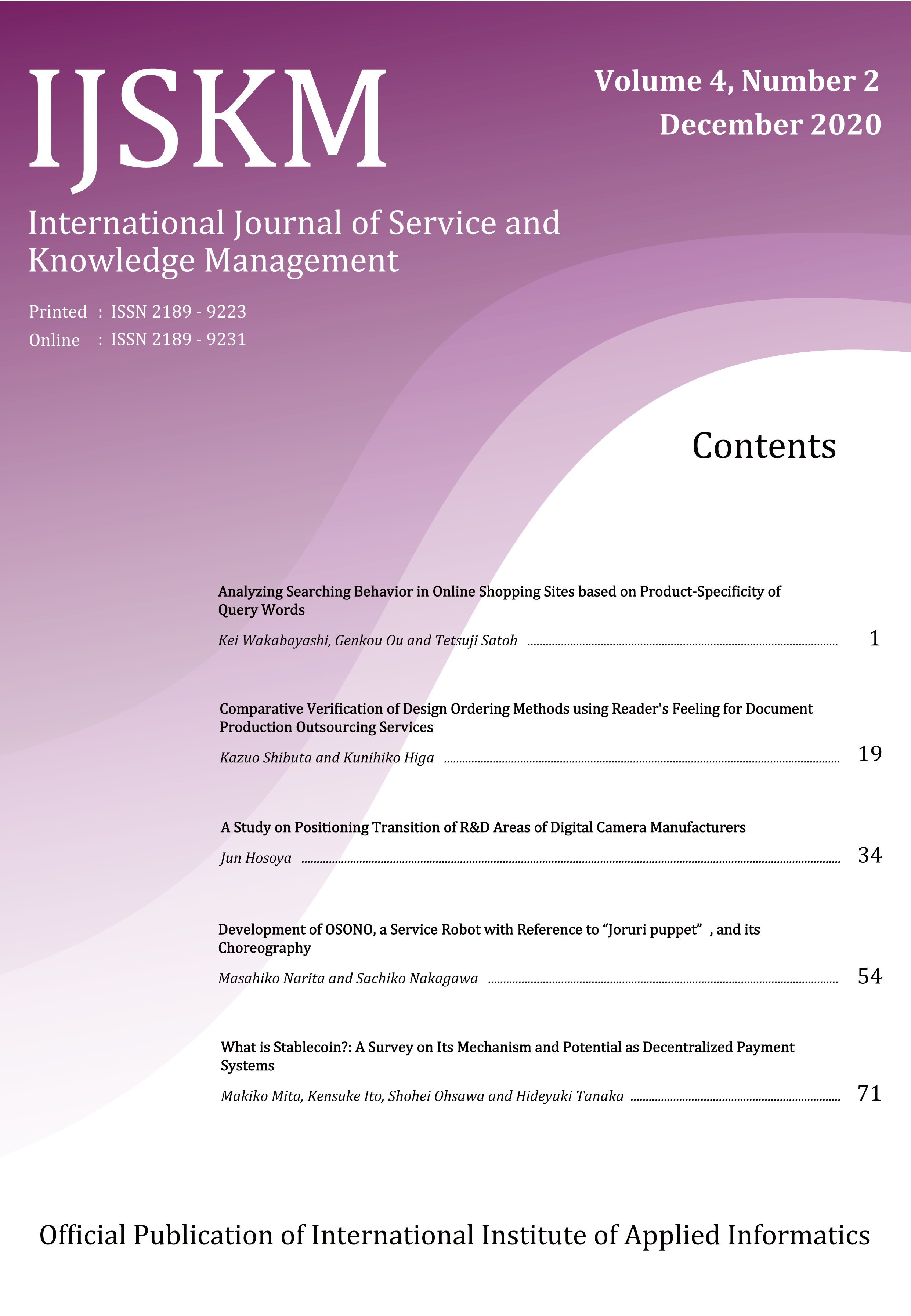

What is Stablecoin?: A Survey on Its Mechanism and Potential as Decentralized Payment Systems

Abstract

Our study provides a survey on how existing stablecoins—cryptocurrencies aiming at price stabilization—peg their value to other assets, from the perspective of Decentralized Payment Systems (DPSs). This attempt is important because there has been no preceding surveys focusing on the stablecoin as DPSs, i.e., the one aiming at not only price stabilization but also decentralization. For clarity, we first classified existing stablecoins into four types according to their collaterals (fiat, commodity, crypto, and non-collateralized) and pointed out the high potential of non-collateralized stablecoins as DPSs; then, we further classified existing non-collateralized stablecoins into two types according to their intervention layers (protocol, application) and confirmed details of their representative m echanisms. Utilizing concepts such as Quantity Theory of Money (QTM), Tobin tax, and speculative attack, our survey revealed the status quo where, despite the high potential of non-collateralized stablecoins, they have no standard mechanism to achieve the stablecoin for practical DPSs.

References

S. Nakamoto, “Bitcoin: A peer-to-peer electronic cash system,” 2008.

C. Dictionary, “Definition of a cryptocurrency,” URL: https://www. merriam-webster. com/dictionary/cryptocurrency, 2018.

V. A. Maese, A. W. Avery, B. A. Naftalis, S. P. Wink, and Y. D. Valdez, “Cryptocurrency: A primer,” Banking LJ, vol. 133, p. 468, 2016.

R. Houben and A. Snyers, Cryptocurrencies and blockchain: Legal context and implications for financial crime, money laundering and tax evasion. 2018.

CoinMarketCap, “Bitcoin charts.” https://coinmarketcap.com/currencies/bitcoin. [Accessed: 20-March-2019].

CoinMarketCap, “Global charts.” https://coinmarketcap.com/charts. [Accessed: 20-March-2019].

B. around the World, “The world’s top 50 companies.” https://www.relbanks.com/rankings/worlds-largest-companies. [Accessed: 20-March-2019].

F. Giulia and V. Pramod, eds., Decentralized Payment Systems: Principles and Design, 2019. http://pramodv.ece.illinois.edu/pubs/Decentralized-PaymentSystems-Principles-and-Design.pdf, [Accessed: April-03-2019].

R. Kaushal, “Bitcoin: First decentralized payment system,” International Journal Of Engineering And Computer Science, vol. 5, no. 5, 2016.

A. Xu, M. Li, X. Huang, N. Xue, J. Zhang, and Q. Sheng, “A blockchain based micro payment system for smart devices,” Signature, vol. 256, no. 4936, p. 115, 2016.

R. Pass and A. Shelat, “Micropayments for decentralized currencies,” in Proceedings of the 22nd ACM SIGSAC Conference on Computer and Communications Security, CCS ’15, (New York, NY, USA), p. 207–218, Association for Computing Machinery, 2015.

G. Danezis and S. Meiklejohn, “Centrally banked cryptocurrencies,” Journal of Cryptology, 2016.

C. I. 30, “Cryptocurrency index 30: Cci30.” https://cci30.com/. [Accessed: 5-May-2020].

R. Jakubauskas, “How many people actually own cryptocurrency?.” https://daliaresearch.com/blog/how-many-people-actually-owncryptocurrency/, May 2018. [Accessed: 20-March-2019].

J. Lund, “Stable coins: Enabling payments on blockchain through alternative digital currencies.” https://www.ibm.com/blogs/blockchain/2018/07/stablecoins-enabling-payments-on-blockchain-through-alternativedigital-currencies/, July 2018. [Accessed: 5-May-2020].

N. Tomaino, “Stablecoins: A holy grail in digital currency.” https://thecontrol.co/stablecoins-a-holy-grail-in-digital-currency-b64f3371e111, April 2017. [Accessed: 5-May-2020].

H. Hassani, X. Huang, and E. Silva, “Banking with blockchain-ed big data,” Journal of Management Analytics, vol. 5, no. 4, pp. 256–275, 2018.

G. Hileman, “State of stablecoins (2019),” Available at SSRN, 2019.

A. R. Zhang, A. Raveenthiran, J. Mukai, R. Naeem, A. Dhuna, Z. Parveen, and H. M. Kim, “The regulation paradox of initial coin offerings: A case study approach,” Frontiers in Blockchain, vol. 2, p. 2, 2019.

M. T. M. Griffoli, M. M. S. M. Peria, M. I. Agur, M. A. Ari, M. J. Kiff, M. A. Popescu, and M. C. Rochon, Casting Light on Central Bank Digital Currencies. International Monetary Fund, 2018.

I. Fisher, “” the equation of exchange,” 1896-1910,” The American Economic Review, vol. 1, no. 2, pp. 296–305, 1911.

I. Fisher, The purchasing power of money: its’ determination and relation to credit interest and crises. Cosimo, Inc., 2006.

J. Tobin, “The new economy one decade older,” The Jane Lectures on Historical Economics, 1974.

J. Tobin, “A proposal for international monetary reform,” Eastern economic journal, vol. 4, no. 3/4, pp. 153–159, 1978.

N. McCulloch and G. Pacillo, “The tobin tax: a review of the evidence,” IDS Research Reports, vol. 2011, no. 68, pp. 1–77, 2011.

P. B. Spahn, “International financial flows and transactions taxes: survey and options,” 1995.

D. Liuzzi, P. Pellizzari, and M. Tolotti, “Optimality of a two-tier rate structure for a transaction tax in an artificial market,” in International Conference on Practical Applications of Agents and Multi-Agent Systems, pp. 95–106, Springer, 2017.

P. Krugman, “A model of balance-of-payments crises,” Journal of money, credit and banking, vol. 11, no. 3, pp. 311–325, 1979.

S. W. Salant and D. W. Henderson, “Market anticipations of government policies and the price of gold,” Journal of political economy, vol. 86, no. 4, pp. 627–648, 1978.

M. Obstfeld, “Rational and self-fulfilling balance-of-payments crises,” tech. rep., National Bureau of Economic Research, 1984.

M. Obstfeld, “Models of currency crises with self-fulfilling features,” European economic review, vol. 40, no. 3-5, pp. 1037–1047, 1996.

R. Chang and A. Velasco, “Financial crises in emerging markets,” tech. rep., National Bureau of Economic Research, 1998.

D. W. Diamond and P. H. Dybvig, “Bank runs, deposit insurance, and liquidity,” Journal of political economy, vol. 91, no. 3, pp. 401–419, 1983.

B. Routledge and A. Zetlin-Jones, “Currency stability using blockchain technology,” tech. rep., Society for Economic Dynamics, 2018.

J. A. Kroll, I. C. Davey, and E. W. Felten, “The economics of bitcoin mining, or bitcoin in the presence of adversaries,” in Proceedings of WEIS, vol. 2013, p. 11, 2013.

T. Limited, “Tether – stable digital cash on the blockchain.” https://tether.to/, 2015. [Accessed: 27-May-2020].

Digix, “Digix — the future of owning gold is digital.” https://digix.global/#/, 2014. [Accessed: 27-May-2020].

G. of Venezuela, “El petro - sembrando la soberan´ıa tecnologica.” ´ https://www.petro.gob.ve/, 2018. [Accessed: 27-May-2020].

TheLibraAssociationMembers, “libra white paper.” https://libra.org/en-US/white-paper/?noredirect=en-US, June 2019. [Accessed: 3-July-2019].

Z. Amsden, R. Arora, S. Bano, M. Baudet, S. Blackshear, A. Bothra, G. Cabrera, C. Catalini, K. Chalkias, E. Cheng, et al., “The libra blockchain,” URl: https://developers. libra. org/docs/assets/papers/the-libra-blockchain. pdf, 2019.

S. Brooks, A. Jurisevic, M. Spain, and K. Warwick, “Havven: A decentralised payment network and stablecoin.” https://www.synthetix.io/uploads/havven_whitepaper.pdf, June 2018. [Accessed: 30-April-2020].

Synthetix.io, “Synthetix litepaper v1.4.” https://www.synthetix.io/uploads/synthetix_litepaper.pdf, March 2020. [Accessed: 30-April-2020].

MakerDAO, “The dai stablecoin system.” https://makerdao.com/en/whitepaper/sai/, 2015. [Accessed: 27-May-2020].

G. Wood et al., “Ethereum: A secure decentralised generalised transaction ledger,” Ethereum project yellow paper, vol. 151, no. 2014, pp. 1–32, 2014.

V. Buterin et al., “Ethereum: A next-generation smart contract and decentralized application platform,” URL https://github. com/ethereum/wiki/wiki/% 5BEnglish% 5DWhite-Paper, vol. 7, 2014.

LienProtocol, “idol white paper.” https://lien.finance/pdf/iDOLWP_v1.pdf, April 2020. [Accessed: 28-April-2020].

R. Tiutiun, L. Porco, M. Gord, and D. S. Lee, “Usdx: A decentralized monetary policy system,” 2018.

N. Al-Naji, J. Chen, and L. Diao, “Basis: a price-stable cryptocurrency with an algorithmic central bank,” Formerly known as: Basecoin Version 0.99, vol. 7, 2017.

G. Hileman and M. Rauchs, “2017 global blockchain benchmarking study,” 2017.

OECD, “Oecd blockchain primer.” https://www.oecd.org/finance/OECDBlockchain-Primer.pdf, 2018. [Accessed: 10-May-2020].

S. Raval, Decentralized applications: harnessing Bitcoin’s blockchain technology. ” O’Reilly Media, Inc.”, 2016.

K. Saito and M. Iwamura, “How to make a digital currency on a blockchain stable,” Future Generation Computer Systems, vol. 100, pp. 58–69, 2019.

M. Iwamura, Y. Kitamura, T. Matsumoto, and K. Saito, “Can we stabilize the price of a cryptocurrency?: Understanding the design of bitcoin and its potential to compete with central bank money,” tech. rep., Institute of Economic Research, Hitotsubashi University, 2014.

F. Saleh, “Volatility and welfare in a crypto economy,” Available at SSRN 3235467, 2019.

P. A. Diamond, “National debt in a neoclassical growth model,” The American Economic Review, vol. 55, no. 5, pp. 1126–1150, 1965.

I. Stewart, “Proof of burn - a potential alternative to proof of work and proof of stake.” https://bitcointalk.org/index.php?topic=131139.0%202, 2012. [Accessed: 7-May-2019].

I. Georgoula, D. Pournarakis, C. Bilanakos, D. Sotiropoulos, and G. M. Giaglis, “Using time-series and sentiment analysis to detect the determinants of bitcoin prices,” Available at SSRN 2607167, 2015.

L. Kristoufek, “What are the main drivers of the bitcoin price? evidence from wavelet coherence analysis,” PloS one, vol. 10, no. 4, 2015.

T. Vidal, “Hash rate and bitcoin price during mining events: Are they related?.” https://cointelegraph.com/news/hash-rate-and-bitcoin-priceduring-mining-events-are-they-related, May 2020. [Accessed: 10-May2020].

S. Voshmgir, Token Economy: How Blockchains and Smart Contracts Revolutionize the Economy. BlockchainHub, 2019.

F. M. Ametrano, “Hayek money: The cryptocurrency price stability solution,” Available at SSRN 2425270, 2016.

M. Morini, “Inv/sav wallets and the role of financial intermediaries in a digital currency,” Available at SSRN 2458890, 2014.

R. Sams, “A note on cryptocurrency stabilisation: Seigniorage shares,” Brave New Coin, pp. 1–8, 2015.

F. A. Hayek, Denationalisation of money: the argument refined: an analysis of the theory and practice of concurrent currencies, vol. 70. Coronet Books Incorporated, 1990.

Q. Wang, “Twitter.” https://twitter.com/QWQiao/status/998213027097989120, May 2018. [Accessed: 14-May-2020].

N. Al-Naji, “Basis.io.” https://www.basis.io/, December 2018. [Accessed: 14-May-2020].

E. Kereiakes, M. D. M. Do Kwon, and N. Platias, “Terra money: Stability and adoption,” 2019.